PHG sponsors deep value add opportunities in gateway markets where we bring in-house expertise. In these situations, we originate, structure and manage the investment.

PHG has completed 25 investments targeting five gateway markets since 2013

Portfolio

Direct Investing

SF Bay Area

PHG, in partnership with SKS, has acquired and redeveloped assets with gross valuation of approximately $500 million in the SF Bay Area. These investments reflect our conviction for opportunities in exceptional locations offering powerful underlying technology demand generators and assets with timeless bones.

Hawaii

PHG has acquired two deep value add hospitality assets in Hawaii, representing an approximate gross asset valuation of $900million, for which we have completed the renovation and repositioning and are currently managing toward stabilization. We believe that the Hawaii hospitality market offers some of the most attractive long-term supply and demand fundamentals in the U.S. and Asia-Pacific Region.

Greater Denver

PHG began its focus on Greater Denver in mid-2020 and has invested in two institutional-grade multifamily projects in the market. Acting as a co-GP in a new development with a local developer and as sole-GP in a deep value add repositioning, these assets represent an approximate gross valuation of $100 million. Our focus on Greater Denver reflects our confidence in the market’s powerful demand generators and fundamentals.

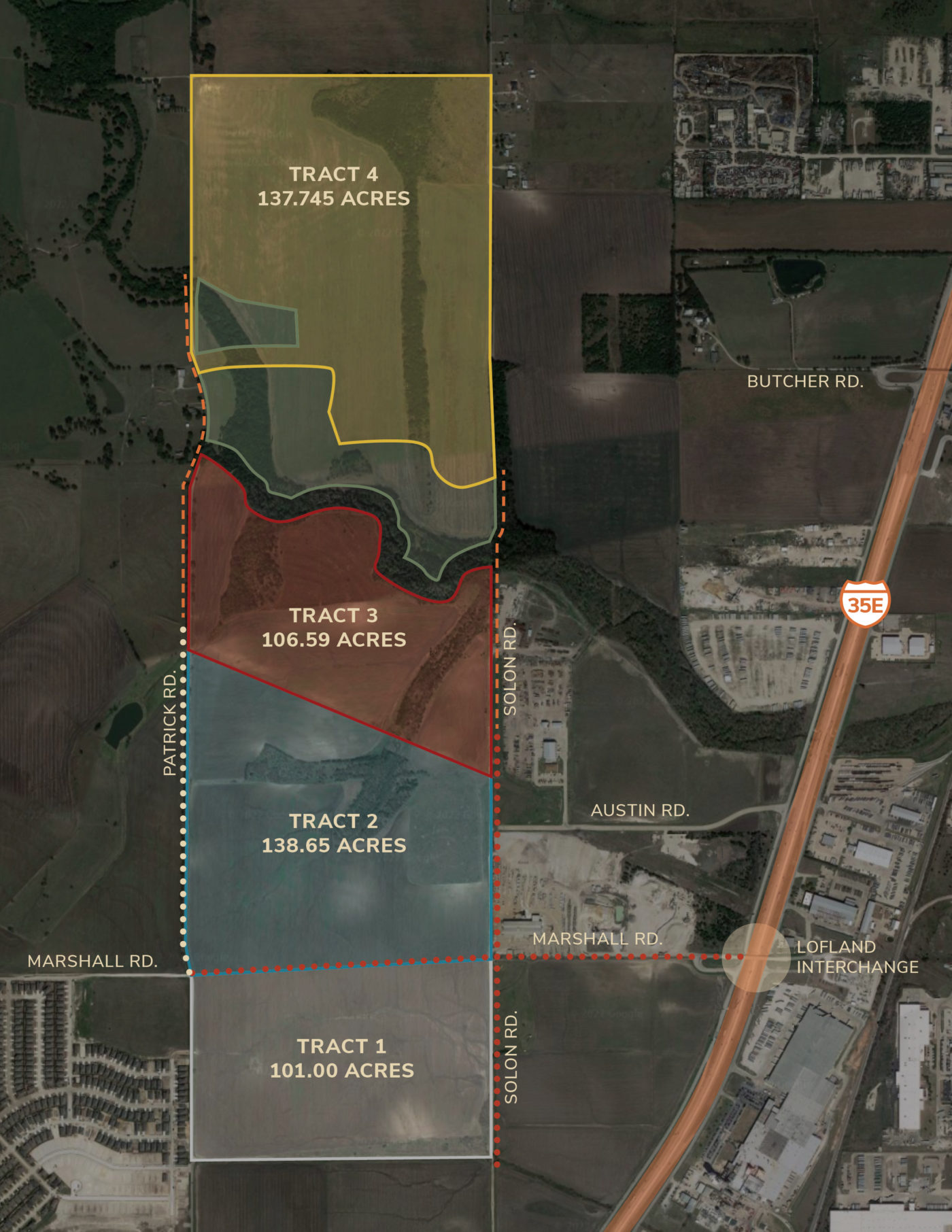

Greater Dallas

PHG partnered with a local developer to acquire, rezone and complete the horizontal infrastructure on a 575 acre master planned industrial park that can accommodate the development of over 6MM square feet of logistics, distribution, manufacturing and other similar industrial uses. This investment in a South Dallas submarket reflects our view that the Greater Dallas industrial will continue to exhibit strong demand, especially for large scale projects in areas with a strong labor base and easy access to both regional and national distribution routes.

Portfolio

Special Situations

PHG participates through other platforms to access opportunities and strategies in markets where we have expertise, but limited local presence. In these situations we invest and assume active board member roles.

London

PHG has an ongoing partnership with Greycoat PLC, a leading Central London developer and operator which has since 2013 acquired assets with gross valuation of approximately £2.5 billion. We believe that London’s size, transparency, and location make it the world’s preeminent global gateway market.

Los Angeles

From 2013 to 2015, PHG participated with GPI Companies in the acquisition of eight assets with gross valuation of approximately $500 million located in dynamic infill markets within Greater Los Angeles. We believe Los Angeles, by offering a lifestyle unique amongst gateway markets, will continue to be a global magnet for the industries of entertainment, defense, technology and healthcare.